Your Dream Practice,

Powered With Buckingham

You have many options to support your business. But to grow a roster of high-net-worth clients in today’s competitive financial landscape, you need more. That’s where we come in.

Your Dream Practice,

Powered With Buckingham

You have many options to support your business. But to grow a roster of high-net-worth clients in today’s competitive financial landscape, you need more. That’s where we come in.

Years ServingAdvisors

0

+

AUM / AUA

$

0

B*

Advisor Network

0

+

Advisors With Us Over 15 Years

0

+

* As of December 31, 2023, BSP had $11.07 billion of discretionary regulatory assets under management and $14.67 billion of non-discretionary regulatory assets under management. In addition, BSP provides administrative, back-office and retirement plan services to $14.45 billion of assets managed or advised by the independent firms that hire BSP for its services. In the aggregate, the total number of assets under management or administration was $40.19 billion.

Who We Are

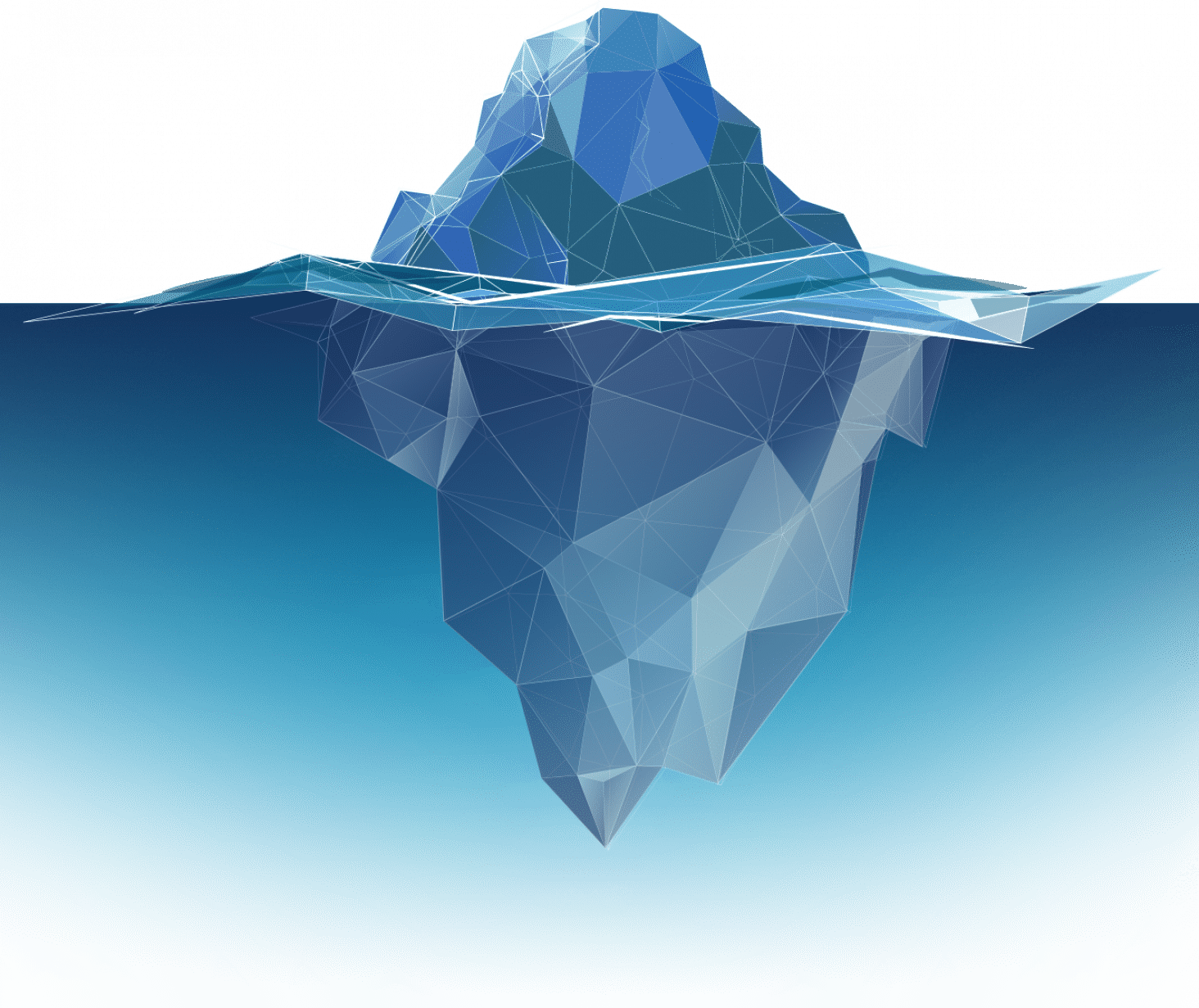

At Buckingham, we are passionate about providing a better wealth experience for financial advisors and their clients. We start by providing the back-office management, research-based investment models and best practices you expect from a TAMP. But that’s only the tip of the iceberg. We strive to create a better experience for financial advisors and their clients by powering below the surface with a competitive toolbox of comprehensive, personalized services. The result? The support you need to provide your best client experience and fuel your firm’s growth.

Marketing Support

- Marketing Playbook

- Marketing Collateral

- Timely Curated Content

- Workshop Toolkits

- Strategic Marketing Alliances

Learn More

Practice Management

- Practice Consulting

- Legal & Compliance Support

- Advisory Business Transition Resources

- Leadership Coaching

- Advisor Learning & Development Program

- Learning Group Opportunities

- Client Segmentation

- Business Succession

- Network of Likeminded Peers

Learn More

Evidence-Driven Investment Models

- Investment Policy & Research Committee

- Evidence-Driven Investment Models

- Flexible Portfolio Management

- Capital Market Assumptions

- Approved & Recommended Securities Lists

- Custom Fixed Income Team

- Asset Location

- Tax Management

- Evidence-Driven Alternative Asset Classes

- ESG Solutions

- Direct Management of Held-Away Accounts

Learn More

Operational Tools

- Dedicated Service Team

- Performance Reporting

- Billing

- Trading & Rebalancing

- Cash Management

- Tax Loss Harvesting

Contact Us

Back Office Support

- Multi-Custodial Oversight

- Account Opening

- Transfer Oversight

- NIGO Resolution

- Account Maintenance

- Paperless Processes

Your Team

Technology Stack

- Vetted Technology Stack

- MoneyGuideElite Planning Platform

- Branded End-Client Portal & Mobile App

- Advanced Investment Analytics Tools

- Risk Assessment Tools

- Outside Account Aggregation

Learn More

Network of Peer Planners

- A network of like-minded advisors

- Nationwide community of 1,200+ CFPs, CPAs, planners more.

- Opportunity to connect, problem solve and learn from professionals just like yourself.

Learn More

Full Business Lifecycle Support

- Startup best practices

- Growth solutions

- Exit planning with CEPA-certified support

- Partnership throughout all phases of your business life cycle

Contact Us

Advanced Analytics Tools

- Leverage Our Proprietary Portfolio Analytics Center

- Analyze Historical Portfolio Performance

- Create Portfolio Comparisons

- Explore Hypothetical Portfolios

Contact Us

Custom Investment Modeling

- Open architecture portfolio construction

- ETFs, mutual funds, SMAs, alternatives

- Customizable fixed income desk

- Prebuilt and customized modeling options

- Asset allocation performance review

- Competitive analysis support and resources

Learn More

Specialty Services

- Retirement Plan Services

- Institutional Investment Services

- Small Business Valuation & Value Enhancement

- High Yield Cash Management Solution

- Lending Partners

- Personal Trust Services

- 30+ Industry Discounts & Curated Partnerships

Contact Us

Growth Strategy

- Leadership coaching

- Staffing and compensation best practices

- Learning and development resources and curriculum

- Curated advice developed through years of advisor experiences

Contact Us

Advanced Planning Team

- Advanced Planning Thought Leadership

- Complex Case Consultations

- Wealth Planning Standards of Care:

- Retirement Planning

- Income Tax Planning

- Estate Planning

- Risk Management

- Health Considerations

- Education Planning

- Business Owner Planning

- Charitable Planning

Learn More

Personalized Client Experience

- Design | Build | Protect® Client Experience

- LifeDiscovery®

- Wealth Planning Conversation Guides

- FeedForward

- Client Communication Strategies

- Client Education Resources

- Life Event Planning

- Event Planning Resources

Contact Us

Wealth Planning Conversations

- Curated planning resources

- Scalable advice

- Tools, resources and practices for approaching a topic

Learn More

“Extremely Friendly, and Knowledgeable”

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Lorem ipsum dolor sit amet, consectetur adipiscing elit.

August 13, 2020 review by Michael C.

August 13, 2020 review by Michael C.

“Extremely Friendly, and Knowledgeable”

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Lorem ipsum dolor sit amet, consectetur adipiscing elit.

August 13, 2020 review by Michael C.

August 13, 2020 review by Michael C.

“Extremely Friendly, and Knowledgeable”

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Lorem ipsum dolor sit amet, consectetur adipiscing elit.

August 13, 2020 review by Michael C.

August 13, 2020 review by Michael C.

“Extremely Friendly, and Knowledgeable”

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Lorem ipsum dolor sit amet, consectetur adipiscing elit.

August 13, 2020 review by Michael C.

August 13, 2020 review by Michael C.

Previous slide

Next slide

What You Expect

Back Office Support

- Multi-Custodian Oversight

- Account Opening

- Transfer Oversight

- NIGO Resolution

- Account Maintenance

- Paperless Processes

Your Team

Practice Management

- Practice Consulting

- Legal & Compliance Support

- Advisory Business Transition Resources

- Leadership Coaching

- Advisor Learning & Development Program

- Learning Group Opportunities

- Client Segmentation

- Business Succession

- Network of Likeminded Peers

Contact Us

Marketing Support

- Marketing Playbook

- Marketing Collateral

- Timely Curated Content

- Workshop Toolkits

- Strategic Marketing Alliances

Learn More

Evidence - Driven Investment Models

- Investment Policy & Research Committee

- Evidence-Driven Investment Models

- Flexible Portfolio Management

- Capital Market Assumptions

- Approval & Recommended Securities Lists

- Custom Fixed Income Team

- Asset Location

- Tax Management

- Evidence-Driven Alternative Asset Classes

- ESG Solutions

- Direct Management of Held-Away Accounts.

Learn More

Operational Tools

- Dedicated Service Team

- Performance Reporting

- Billing

- Trading & Rebalancing

- Cash Management

- Tax Loss Harvesting

Contact Us

What you need to succeed

Technology Stack

- Vetted Technology Stack

- MoneyGuideElite Planning Platform

- Branded End-Client Portal & Mobile App

- Advanced Investment Analytics Tools

- Risk Assessment Tools

- Outside Account Aggregation

Learn More

Network of Peer Planners

- A Network of Like-Minded Advisors

- Nationwide Community of 1,200+ CFP®, CPAs, Planners and More

- Opportunity to Connect, Problem Solve and Learn form Professionals Just Like Yourself

Learn More

Wealth Planning Conversations

- Curated Planning Resources

- Scalable Advice

- Tools, Resources and Practices for Approaching a Topic

Learn More

Personalized Client Experience

- Design | Build | Protect® Client Experience

- LifeDiscovery®

- Wealth Planning Conversation Guides

- FeedForward

- Client Communication Strategies

- Client Education Resources

- Life Event Planning

- Event Planning Resources

Contact Us

Full Business Lifecycle Support

- Startup Best Practices

- Growth Solutions

- Exit Planning with CEPA-Certified Support

- Partnership Throughout All Phases of Your Business Life Cycle

Contact Us

Advanced Planning Team

- Advanced Planning Thought Leadership

- Complex Case Consultations

- Wealth Planning Standards of Care:

- Retirement Planning

- Income Tax Planning

- Estate Planning

- Risk Management

- Health Considerations

- Education Planning

- Business Owner Planning

- Charitable Planning

Learn More

Specialty Services

- Retirement Plan Services

- Institutional Investment Services

- Small Business Valuation & Value Enhancement

- High Yield Cash Management Solution

- Lending Partners

- Personal Trust Services

- 30+ Industry Discounts & Curated Partnerships

Contact Us

Custom Investment Modeling

- Open Architecture Portfolio Construction

- ETFs, Mutual Funds, SMAs, Alternatives

- Customizable Fixed Income Desk

- Prebuilt and Customized Modeling Options

- Asset Allocation Performance Review

- Competitive Analysis Support and Resources

Learn More

Advanced Analytics Tools

- Leverage Our Proprietary Portfolio Analytics Center

- Analyze Historical Portfolio Performance

- Create Portfolio Comparisons

- Explore Hypothetical Portfolios

Contact Us

Growth Strategy

- Leadership Coaching

- Staffing and Compensation Best Practices

- Learning and Development Resources and Curriculum

- Curated Advice Developed Through Years of Advisor Experiences

Contact Us

"Do We Buy It or Do We Build It?"

It’s a question every growing business faces. Clients are insisting on more services from advisory firms, and firms must adapt to meet those changing demands. At the intersection of those dynamics is time and scale.Learn More

“Partnering with Buckingham”

Buckingham has become an extension of the team and the client experience is enhanced by having the resources and support that we do within the Buckingham community.Partner at Delap Wealth Advisory Jared Siegel, BFA™, CEPA®

* As of March 31, 2022 BSP had $3.04 billion of discretionary regulatory assets under management and $15.46 billion of non-discretionary regulatory assets under management. In addition, BSP provides administrative, back-office and retirement plan services to $20.17 billion of assets managed or advised by the independent firms that hire BSP for its services. In the aggregate, the total number of assets under management or administration was $38.66 billion.

Evidence-Driven Investing™

We believe that investment advice should be based on facts, not personal opinions. Our approach is driven by decades of peer reviewed academic and practitioner research and data, rooted in the principles of diversification to reduce risk and tax efficiency.Larry Swedroe, Head of Financial and Economic Research Read More

Are You Staying Ahead of the Curve?

How do you stay ahead of the competition? Buckingham’s Michael Ozburn explores the benefits of advisors outsourcing time-consuming tasks to stay ahead of the curve.Read More

Schedule a Call with a Regional Director

Let’s open the conversation about your growth, the support you’re looking for, the clients you serve and work-life balance. In less than 30 minutes, we will both know how Buckingham can change your practice and your life.Let's Talk

The Next Level of Scale

In 2020, I was faced with my own decision of choosing a new firm to affiliate with for the first time in 17 years, to get to the next level of scale in my own business. Given the success of our Kitces platform, I could have called anyone in the industry. But I only made one phone call: to Buckingham. Michael E. Kitces Head of Planning StrategyLearn More