The Value of a Financial Advisor: How to Consider the Costs and Benefits

Here’s what individual investors should know when assessing the value of working with a financial advisor.

Quarterly Outlook: Economic Momentum Continues

At the start of Q2 2024, the American economy remains resilient with surprisingly solid growth.

Caring for Aging Parents: The Essential Planning Guide

In an era marked by unprecedented longevity and shifting family dynamics, caring for aging parents is a challenge that many Americans are facing.

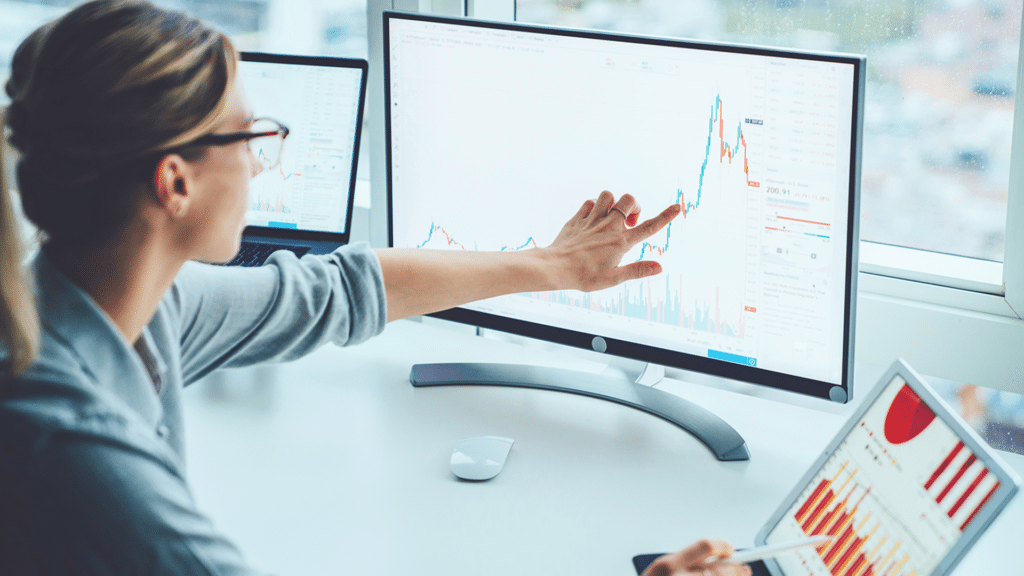

Protecting Your Portfolio in a Presidential Election Year

While elections have the potential to reshape policies and legislation, it’s difficult to predict which sectors or industries could benefit. Here’s what to keep in mind this election season.

Demystifying Restricted Stock Units: A Guide to Your Organization’s Compensation Program

Congratulations! As part of your organization’s compensation program, you’ve been given restricted stock units (RSUs). You’re probably thrilled by the potential extra income, but amid the excitement, it’s important to understand what RSUs entail and how to maximize their benefit. RSU basics RSUs are shares of company stock given to an employee. This incentive is […]

How Your Advisor Can Build a Plan Based on Your Values

Your values drive every decision you make in life. So, what does that mean for your financial plan?

Building a Strong Financial Advisory Business: The Impact of Branding, Marketing and Client Experience

Financial advisors must navigate the intricacies of branding, marketing and client experience to stand out in a crowded marketplace.

5 Financial Planning Tips for Welcoming a Baby

When planning for the arrival of your new bundle of joy, don’t forget to babyproof your finances.

How to Protect Children from Identity Theft

According to research, kids could be up to 51 times more likely than adults to be the victims of identity theft. To ensure your child’s credit score stays protected, here are the top three measures you can take to safeguard their future.

Top 10 Investment Lessons of 2023

Last year was full of unexpected events – from a regional banking crisis, to rising geopolitical risks and skyrocketing mortgage rates. Here are the top 10 lessons for investors.

Quarterly Outlook: Is a Soft Landing in Sight?

Will the Fed begin lowering rates for this year? Our Quarterly Outlook explores what may lie ahead for markets.

The New Year Brings Big Questions for Markets

With uncertainty surrounding future monetary policy and a looming presidential election, Investment Strategy Manager Alex Kluesner looks at the biggest questions ahead and the implications for your portfolio.

The Gift that Lasts Forever: Teaching Your Children About Money

How and when should you begin teaching your children about the value of money? Starting early can make a big impact over multiple generations.

2024 Planning Considerations and Strategies for Individual Taxpayers

They say hindsight is 20/20, but tax planning shouldn’t simply be based on what has worked in the past. Upcoming life changes and external factors such as tax policy developments also deserve attention and may offer money-saving opportunities. With that in mind, here are several of the most important tax-planning considerations and deadlines to remember […]

4 Charitable Giving Strategies to Maximize Your Impact

With the year coming to an end, now is an excellent time to revisit your philanthropic plan and review the tools you want to employ in 2024. Whether your household’s charitable routine involves regular or seasonal giving, the IRS has approved several strategies that have the potential to put more of your funds into the […]

Small Steps to Take Before 2024 That May Help Save Big

While taxes may be the last thing on your mind during the holiday season, small steps you take now may result in big savings on your 2023 tax bill. From maximizing deductions to optimizing investment strategies, some simple yet proactive measures can help you keep your hard-earned money in your pocket. I have compiled a […]

Social Security and Medicare: How to Plan for Next Year

Find out why reviewing your Medicare plans now may lead to significant health care savings over the long term.

Quarterly Outlook: Too Early to Declare Victory Against Inflation

Is the Fed finished hiking rates for the year? Our quarterly outlook explores why the economy may not be cooling enough to slow inflation.

Are You Staying Ahead of the Curve?

Like so many of us, I joined the financial planning industry to make a positive impact on people’s lives. I have always found it rewarding to help clients fulfil their lifelong dreams, guide them in periods of transition and provide support during challenging times. However, as firms grow, advisors are often forced to focus on […]

The Rise of the Female Breadwinner: Key Planning Tips and Considerations

Over the past several decades, women have increasingly taken on the responsibility as their family’s primary or sole breadwinner. This rising role has prompted a different approach to comprehensive financial guidance. Wealth Advisor Alyssum Malone, CFP®, BFA™ shares how partnering with a professional can help ensure your family’s finances are protected for years to come, […]

The Best Advisors Don’t Ask for Referrals … But Here’s How They Receive Them!

A very good friend and his wife recently came into town and asked me for a restaurant recommendation in the Santa Cruz area. I am always happy to help acquaintances with these “tough” problems. I asked their food preference, and without hesitation he answered Italian. I immediately had the perfect place in mind. You see, […]

How Investor Expectations Are Driving Stock Prices

This year, there has been more optimism in the stock market compared to 2022. For investors only looking at the returns of the S&P 500, it may seem like the economy is in a boom. This dynamic may be surprising, given the rising interest rates and forecasts for slower growth.

Managing Your Practice

Recently, Ben Slater was featured on Dimensional’s “Managing Your Practice” podcast, sharing his thoughts on leveraging scale and taking your practice to the next level.

6 Steps to Plan for a Future Inheritance

Whether you’re expecting a life-changing inheritance or not expecting anything from your loved ones, conversations about this topic can be uncomfortable. Planning early makes it easier to navigate the important steps to ensure a transfer of wealth goes smoothly.

Do We Buy It or Do We Build It?

It’s a question every growing business eventually faces: Do we buy it or do we build it? To meet client demands and create economies of scale, companies like Apple, Amazon, Netflix and Microsoft all buy some of their services. Conventional wisdom mandates that a modern company only build tools that enhance ROI and build up […]

Fee-Only and Fiduciary: What It Means for Your Financial Planning

The model in which financial advisors earn income could influence their recommendations, which may impact your return on investments, long-term objectives and portfolio performance. Choosing a financial advisor is a deeply personal and potentially life-altering decision. It’s important to partner with someone you connect with, a professional dedicated to putting your best interest first. Their […]

Maximizing Health Care Savings in Retirement With an HSA

Depending on your medical needs and those of your family, you may have enrolled in a high-deductible health plan that allows you to pay for medical expenses using a health savings account (HSA). Because contributions go into an HSA pre-tax, grow tax-deferred and are distributed tax-free when used for qualifying costs, this option has gained […]

Demystifying the Income Tax Reporting System

Once tax season is over, it’s not too uncommon for taxpayers to receive an inquiry letter for more information about their returns. But have you ever wondered why?

The Power of an Enrolled Agent as Your Financial Advisor

Amanda Otto shares what an EA is and how this advisor provides valuable insights on tax-efficient investment strategies, retirement planning, estate planning and more.

6 Key Financial Considerations for Unmarried Couples

Marriage may not be part of the plan for every couple. These strategies can help unmarried couples avoid conflict while working toward their financial goals together.

100 Buckingham Advisor Named in Investopedia’s 100

At Buckingham Wealth Partners, we pride ourselves on cultivating talented and passionate professionals from the industry and industry peers across the nation agree on our hiring selections! Cheers to Buckingham Wealth Partners’ Head of Planning Strategy Michael Kitces for once again being awarded Investopedia’s Most Influential Advisor. Michael’s respected thought leadership, ability to shape strategic priorities, passion […]

Quarterly Outlook Q3 2023: Recession Predictions Linger

Although there have been some signs of progress, our quarterly outlook explores why it has been so difficult to slow inflation.

Navigating Alternative Investment Strategies

Wondering if alternative investments are right for your portfolio? Although we remain skeptical of most alternative strategies, we’ve found a few that may benefit a well-constructed portfolio.

The Financial and Emotional Impact of Sudden Wealth

Whether it’s from an inheritance, settlement, divorce, a major sale, initial public offering (IPO) of your business or winning the lottery, most people would agree coming into a large sum of money is a good problem to have. We have all dreamed about having the resources to instantly pay off our mortgage, purchase a new […]

Levers and Landmines of Annuity Products

Annuities are a popular way to supplement retirement income, provide tax-deferred growth and assist in legacy planning. But what are your options when an annuity no longer serves you? Annuities can be a key component in a robust retirement plan. These insurance contracts provide a low-risk opportunity to increase your guaranteed income stream, provide tax-deferred […]

Pre-Tax or Roth? Your 401(k) Options Explained

Your personal financial goals can help determine whether you want to pay taxes now or later on retirement contributions.

Private Equity and the Fear of Missing Out

Some investors are wondering if private equity would be a good addition to their portfolio. Here’s a breakdown of this evolving asset class. For reality TV fans, one might argue that the private equity world truly took off last year: Celebrity Kim Kardashian launched her own private equity firm. There is now over $4 trillion […]

How to Assess the Top 5 Risks in Retirement

Retirees face five key risks when planning their lifestyle after their working years, and more surprisingly, they often underestimate them. Here’s what retirees should know to prepare.

Small Business Tax Mistakes to Avoid

For small business owners, a misstep in tax planning could result in a big, unforeseen bill.

Quarterly Outlook Q2 2023: Inflation Battle Wages On

In our quarterly outlook, we explore the Fed’s actions to curb inflation and how these are likely to continue despite recent turmoil in the banking sector.

Timely Strategies to Get Ahead of Student Loan Repayments

While you can’t control the legal battles over student loan forgiveness, you can take advantage of several student loan programs in 2023. (On Aug. 30, 2023, this article was updated to reflect the latest developments and deadlines related to student loan planning.) As millions of Americans gear up to resume student loan payments after a […]

Does Investing Internationally Still Make Sense?

Although risks abroad can be worrying, such as the ongoing war in Ukraine, investing in foreign companies remains a key diversification strategy. Find out why having international investments in your portfolio is beneficial.

The Right Time to Buy? How to Factor in Higher Mortgage Rates

Even if the current market isn’t considered optimal for buyers, it may still be the right time for you.

Funding a College Education with Taxes in Mind

While 529 plans are a popular way to fund expensive college educations, Buckingham Senior Tax Manager Shawn Williamson shares more options that may benefit both students and parents from a tax standpoint. According to a recent study, a year of tuition, books, supplies and day-to-day living expenses at a four-year university will cost on average […]

Engage 2023 | June 5-8, 2023

Join us at Engage 2023 The pace of accounting and finance is constantly evolving. From tackling emerging complexities and challenges head on to embracing ever-changing technology, it’s imperative to be forward thinking. You can’t afford to fall behind on advancing your skill set, pivoting your business needs, creating new revenue lines and utilizing the latest […]

Recently Widowed: Dealing with Immediate Financial Concerns and Planning for the Future

The strong emotions associated with the death of a spouse can become even more amplified by the overwhelming host of financial issues that need to be addressed. Where does one start? Losing a spouse is a life-changing event that married couples unfortunately need to be prepared for. Since survivors are faced with the daunting tasks […]

Buckingham’s Power of Partnership Workshop | April 19, 2023 – April 20, 2023

Looking to learn more about Buckingham Strategic Partners? Increasing your firm’s efficiency, scale and engagement don’t happen by accident or luck. They are born from leveraging the powerful resources of a forward-thinking, comprehensive advisor platform. If you are searching for a partner who is committed to helping you grow your firm, develop deeper client relationships […]

Avoiding Fraud, Theft and Overcharges

Senior Tax Manager Shawn Williamson provides several tips on how to safeguard your company’s assets.

2022’s Investment Lessons

While each year features new twists on the age-old investment stories, smart investors know how to apply the same basic principles to every event.

Economic Views: Inflation May Have Peaked as New Year Begins

As the new year begins, markets have grown somewhat more optimistic that the Federal Reserve will successfully bring inflation down without causing a deep recession.

2023 Planning Considerations and Strategies for Individual Taxpayers

Explore our list of key planning strategies and deadlines to make the most out of your 2023 tax season.

Ring in the New Year with a Fresh Look at Your Financial Plan

January is not only a perfect time to implement your personal and professional resolutions – it’s also a great reminder to review your financial goals, plans and strategies. Decades of data have proven that successful financial outcomes are more likely to happen because of purposeful and thoughtful planning. As we start 2023, I recommend my […]

How to Share Your Values with Legacy Letters

In wealth planning, it’s important to consider not just tangible assets but also the impact you hope to make on your community and family. This is often called one’s legacy, and a big component of that is intangible assets: your values and life lessons that can be passed down to future generations. As families and […]

Buckingham’s Leadership Team’s Book Recommendation

This holiday season, if you are looking for a book recommendation for your favorite bibliophile, yourself, a family member, friend or colleague, Buckingham’s Leadership Team is spreading the cheer by sharing a few of their recommended reads. “My father shared a copy of one of Larry Swedroe’s books at the beginning of my career, and […]

Inherited an IRA? Here’s Why Planning Distributions Early Matters

If you’ve inherited an IRA recently, here’s what you need to know about planning distributions and keeping up with changing tax rules.

The Great Retirement Debate

In his latest venture, Jeff Levine has teamed up with financial heavyweight Ed Slott of Ed Slott and Company to launch a brand new, consumer-friendly podcast, The Great Retirement Debate. In each episode, Jeff and Ed will go head-to-head knocking out critical topics in the retirement landscape. Through a coin flip, they take opposing sides […]

Top 10 Things to Do Before 2022 is Over

The holidays usher in a joyful time of family gatherings, holiday parties, fun with friends and the promise of a bright new year. But before you put a bow on 2022, there are a few financial housekeeping tasks that you should review. From my experience with clients, I have compiled a top ten list of […]

Clearing Financial Advisor’s Biggest Hurdles

Simply put, our goal at Buckingham Strategic Partners is to solve the problems financial advisors face on a daily basis. Like many “TAMPs”, we offer evidence-driven investment models, back-office support, portfolio management software and reporting, practice management and marketing support. But that’s only our warmup. Every day, we strive to bring industry leading services to […]

How To Navigate Your Student Debt Relief Options

There are three major parts to Biden’s plan to help those dealing with student loan debt. Over the past 12 months, the Department of Education under the Biden-Harris administration has championed a metric ton of program revisions and policy changes to the federal student loan system. The most recent Student Loan Debt Relief Plan, announced […]

Should You File for Social Security Early to Capture the Inflation Adjustment?

Social Security benefits will go up 8.7% in 2023, the largest adjustment in four decades. Here’s why you don’t need to rush to file to benefit from the increase. With all the talk about inflation these days, you may have heard the news that the 2023 cost-of-living adjustment (COLA) for Social Security benefits is 8.7%, […]

The A, B, Cs of Medicare

From Oct. 15 to Dec. 7, 2022, qualified participants can sign up to take part in the federal government’s insurance plan. If you are overwhelmed by the process, definitions and complexities of Medicare, you are not alone. According to the Centers for Medicare & Medicaid Services (CMS), almost 64 million Americans were fully enrolled in […]

Economic Brief: Labor Market Remains Tight As Global Risks Rise

While inflation has moderated since June, it remains stubbornly high. Shocks happening abroad are the main contributor.

What Caused Market Volatility To Rise

September turned out to be a tough month for markets after performance started to look a little brighter late this summer.

5 Reasons Your Financial Advisor Should Review Your Will

Financial advisors can offer a different perspective about the legal terms in estate documents and what they will mean financially for you and those who inherit your assets.

How To Start Strategizing for Charitable Giving Season

Starting to plan your charitable giving strategies now will prevent you from feeling rushed to meet year-end deadlines. It will also give you the time to think carefully about which causes fit best in your long-term legacy plan.

How to Find an Advisor You Can Trust

Several years ago, I met with a wealthy widow who had been quite a bit wealthier before meeting Mr. Bernie Madoff. After that devastating experience, she was very concerned about finding an advisor she could trust to act in her best interest. I know she is not the only person who has questions and concerns […]

The Game Changing Power of Conviction

To serve clients in an impactful manner, we can’t just think we are doing the right thing for them, we have to know it in our core.

Why Businesses Should be Treated as Investments

A business is typically its owner’s largest and most complex investment. It is also a fundamental piece of their personal retirement plan. But what if the business owner’s perceived value of the company does not reflect its true value? This could derail their personal retirement plan and their future lifestyle. Unfortunately, this happens often because […]

Should You Refinance Your Student Loans?

As a Buckingham Practice Integration Advisor, I am often asked this question: “My student loans are in forbearance. Should I look to refinance now?” Like most of life’s situations, there is not a “one size fits all” answer to this question. Instead, one must look at their personal circumstances before making the decision to refinance […]

What Should I Be Thinking About When Making a Capital Investment in a Rising Rate Environment?

Whether you want to upgrade to the newest technology, need to replace worn equipment or give your lobby a facelift, what should you consider before making a capital investment in your business? Unlike recent years, business owners now face increasing costs to carry debt. How do you make improvements to your business while still remaining […]

Independent Member of Buckingham Strategic Partners Joins Michael Kitces’ #FA Success Podcast

Are you looking for a TAMP that fits your firm’s growing needs? With so many choices in the marketplace, it may be difficult to find a partner that understands your needs. Independent member of the Buckingham Strategic Partner community, Neel Shah of Beacon Wealth Solutions, was in your shoes. He dreamt of growing a firm […]

Why The Location Of Your Investments Matters

Most investors have a process for deciding which investments to buy in their portfolio—with different objectives for building wealth over time. But once you’ve selected your investment mix, have you considered how the account that holds your investments affects what you ultimately earn? A potential game changer for your expected returns is the amount of […]

Invest Like A Girl

Investing can be an overwhelming process. Due to circumstances beyond their control, women face additional challenges and hurdles when it comes to growing their money. As a wealth planner, I have identified several areas of concern that may impact a woman’s financial health. Don’t worry, I’ve also included solutions and tips to help even the […]

Economic Brief: All Eyes On Inflation For The Remainder Of 2022

While there’s always uncertainty in the outlook for the economy and financial markets, a confluence of events has pushed the level of uncertainty to high levels.

The “4 Rs” of Behavioral Finance

In his book, “Thinking, Fast and Slow” , psychologist Daniel Kahneman examines the two brain systems that drive the way we think while also shining light on the common biases that impact decision making. As it turns out, our brains are hard-wired to make fast, intuitive and emotional decisions shaped by our own biases and generalizations. […]

Buckingham Advisors Named in Investopedia’s 100

At Buckingham Wealth Partners, we pride ourselves on cultivating talented and passionate professionals from the industry and industry peers across the nation agree on our hiring selections! Cheers to Buckingham Wealth Partners’ Head of Planning Strategy Michael Kitces for once again being awarded Investopedia’s Most Influential Advisor. Michael’s respected thought leadership, ability to shape strategic […]

Summer, Sun and Scams: Protect your Vacation from Fraud

The summer months kick off many seasons of happiness – the end of the school season for kids, BBQ season, baseball season (this is a happier time for some fans more than others) and vacation season. Over the next few months, millions of Americans will hit the road or take to the skies in search […]

Tax-Loss Harvesting: Making Lemonade out of Lemons

Like kingdoms, tides and my teenage daughter’s emotions, the stock market rises and falls. Although market downturns are inevitable and expected, they are never pleasant to experience. On the bright side, these dips present an opportunity to make the proverbial lemonade out of lemons by allowing Uncle Sam to share the pain. This is accomplished […]

The Human Side of Financial Planning

Buckingham Wealth Advisor and Registered Life Planner® Ken Rosenbaum explains how utilizing an advisor who specializes in Life Planning can help you live your most rewarding, authentic and full life.

Pride Month: How to Build Your LGBTQ Financial Plan

It’s LGBTQ+ Pride Month, and there’s no better way to celebrate than taking pride in your financial life! Buckingham’s Ryne Vickery shares five steps to help same sex couples create a wealth plan and get on the path towards financial freedom.

Prepare Your Portfolio for Midterm Elections

How will the upcoming elections affect your portfolio? Buckingham’s Daniel Campbell offers three points to consider as America heads to the polls.

Leveraging Tax-Savings Opportunities with the Help of an Advisor

Buckingham Client Development Advisor, Amanda Merrill, breaks down four considerations to help maximize your tax-savings opportunities.

The Big Spend

Put down your mask and pick up your credit cards! The big spend is upon us…

Welcome to the Family!

Buckingham is excited to offer a warm welcome to our newest acquisition in Overland Park, Kansas – Lumia Wealth. Headed by Principal and Wealth Advisor Brian R. Brush, Lumia specializes in creating investment strategies for professional couples, physicians, women, members of the LGBTQ community and the socially conscious investor. Founded in 2002, Lumia is a […]

How an Advisor Helps His Daughter Search for Her Dream College

I hope this helps you find schools that will prepare your children for success and happiness without compromising your retirement or other financial goals.

5 Ways Women Can Take Control of Their Finances

Women’s individual and collective experiences, situations, challenges and solutions vary widely. This makes it nearly impossible – and irresponsible – to apply a “one size fits all” approach to women’s wealth management. But one thing we do know, our paths to achieving financial stability and success can vary greatly from those of men. Rather than […]

Join Us at Engage 2022, Save On Registration

Expert programming is the engine that drives AICPA® & CIMA® ENGAGE 22. From new regulatory updates to the latest strategies for high-income individuals, our presenters and panelists will elevate your expertise personal financial planning, estate planning, tax and additional, focused learning tracks. Hear from Buckingham’s Kevin Grogan and Jeffrey Levine as they share their perspectives […]

Planning for a Loved One with Special Needs

The US Census Bureau has reported that one in five individuals suffer from an intellectual, physical or mental disability. While many government programs and benefits are available, it is often hard to maneuver through the sea of red tape to take advantage of them. By not planning for the future of your loved one, you could […]

Part Two: Everything You Need to Know About Tax Fraud

In the second installment of the series, I will explore clues your information may have been compromised.

Part One: Everything You Need to Know About Tax Fraud

In the first installment of this two-part series, I will arm you with helpful information you can use to reduce your odds of becoming a victim of tax-related identity theft.

Identity Theft Checklist and Prevention

Identity Theft Prevention Identity theft occurs when someone steals your personal information to commit fraud, such as fraudulently opening accounts, gaining access to accounts, filing tax returns, filing for unemployment benefits, obtaining medical services, or sending fake bills to your health insurer, etc. Below are different ways to prevent identity theft and protect yourself from […]

Perspectives for 2022: Buckingham’s Thoughts on the Year Ahead

The market will go up and the market will go down. No matter which direction it is headed, your best defense is to speak with your financial advisor about developing a risk-tolerant plan and sticking to it- while, as I like to say, controlling the “controllables.”

5 Strategies We ❤

To mark Valentine’s Day this year, we asked five advisors to spread the love (the love of financial well-being, that is) by sharing a wide range of wealth planning tips that are near and dear to their hearts. So how does Buckingham love thee? Let us count the ways…. 1. Leverage an HSA: “One strategy […]

2021’s Investment Lessons

Every year, the market gifts us invaluable lessons on investment strategies. While each year is different, many of these lessons are reinforced or repeated year after year; that’s why one of my favorite sayings is that there’s nothing new in investing, only investment history you don’t know. Before you read the 10 lessons 2021 taught […]

Patience Pays in Volatile Markets

With the recent uptick in market volatility and the poor start to the year for the U.S. stock market, I wanted to recap where markets stand and reiterate three time-tested principles that I believe are as relevant now as they have been over the modern history of financial markets. Zooming out, it is first important […]

Stay Ahead of the Game: Important 2022 Tax Updates for Baby Boomers

Paying taxes is something you can’t escape; but being aware of new tax rules and revised federal deadlines can make preparing and paying your taxes a little less painful each year. Here are five major tax revisions – plus noteworthy cutoff dates – every baby boomer needs to know ASAP to avoid late fees, cash […]

5 New Year’s Resolutions to Keep You Financially Fit in 2022

We’ve all said it…“I’ll start on January 1.” Whether it’s hitting the gym or eating more vegetables, every year millions of Americans make resolutions to better themselves. Besides building strength with a yoga practice, the new year is a great opportunity to bulk up your financial muscle. As a wealth advisor for over 20 years, […]

Getting Real About Retirement Risks and Rewards

No two retirements are ever going to look exactly the same, because each of us will enter that phase of life with a different set of circumstances, expectations and financial realities. But by exploring a few hypothetical scenarios, we should be able to shed some light on holistic financial planning opportunities, as well as risks, […]

A Refreshing Perspective on Money and Happiness

Eighteenth-century Swiss philosopher Jean-Jacques Rousseau said, “The money you have gives you freedom; the money you pursue enslaves you.” He clearly believed that money alone can’t guarantee happiness, and many other philosophers, business moguls, and philanthropists both before and after his time would agree. After all, it’s likely very few of us in the end […]

5 Opportunities to Create a Living Legacy

WARNING: When planned correctly, witnessing the effect of your generosity and passion can be highly addictive! Most people don’t give much thought to legacy planning aside from considering their will as they age and thinking about what to do with what might be left when they pass away. This approach is not nearly as much […]