As we approach the busy holiday season, now is a great time to start thinking about which charities match your values for end-of-the-year donations. According to Giving USA’s annual report on philanthropy, individuals, bequests, foundations and corporations gave an estimated $484.85 billion to U.S. charities in 2021. This year, charities will likely face more need for financial assistance given the pace of inflation and rising costs.

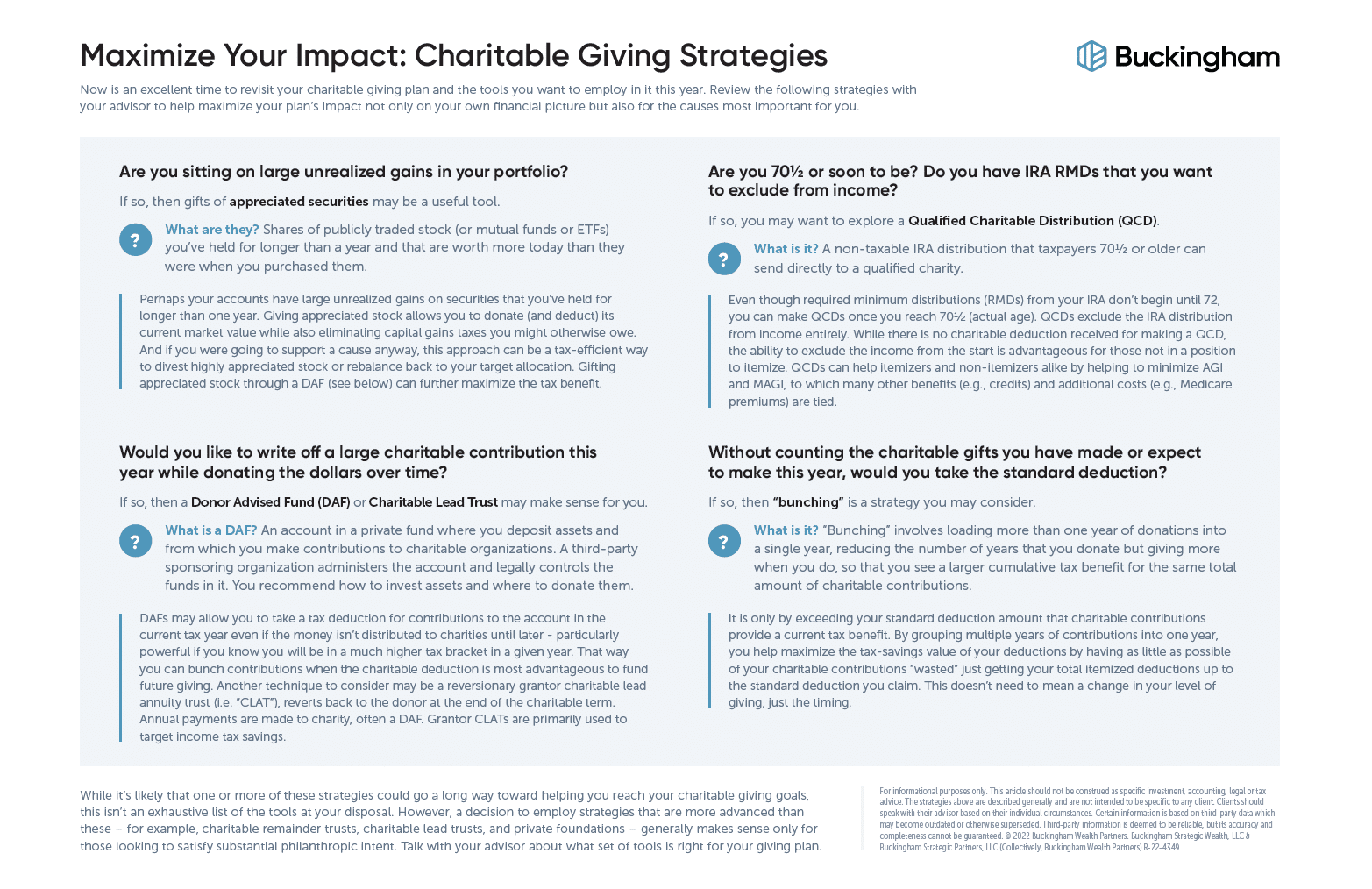

In addition to choosing charities that match your values, your donations have implications for your tax returns and future investment strategies. Financial advisors have the knowledge to help clients meet their gift-giving goals while also being smart about taxes. Explore four ways you can maximize the financial impact of your monetary donation while honoring your wealth plan with our easy-to-understand infographic.

People often approach legacy planning in a chronological life order, focusing on the accumulation of wealth until retirement. When it comes to charitable giving, it’s best to reassess your values and strategies each year. According to Wealth Advisor Elliot Dole, planning for the long term requires a shift in perspective, but it will build the foundation for setting up the ideal legacy and wealth transfer plan. This is becoming especially important for the baby boomer generation, which is expected to donate an estimated 30% of its wealth to charities over the next 20 years.

As every family has a unique set of circumstances, there is not always a one-size-fits-all solution. It’s important for your advisor to understand your hopes, dreams and goals in order to create a plan that passes on more than money; it should also pass on the values you hold most dear.

Schedule a conversation with your advisor to discuss the right plan for your family.

Elliot Dole

Elliot Dole is a CERTIFIED FINANCIAL PLANNER™ professional whose practice is centered around the needs of his clients. As a wealth advisor, Elliot is focused on building tax-efficient financial plans. With specialized knowledge in taxation, Elliot applies his skill set to help clients increase after-tax returns throughout and even beyond their lifetimes. Born and raised in St. Louis, Elliot lives in his hometown with his wife, Elise. He is a lifelong learner and a connoisseur of fine ice cream.