Main Takeaway:

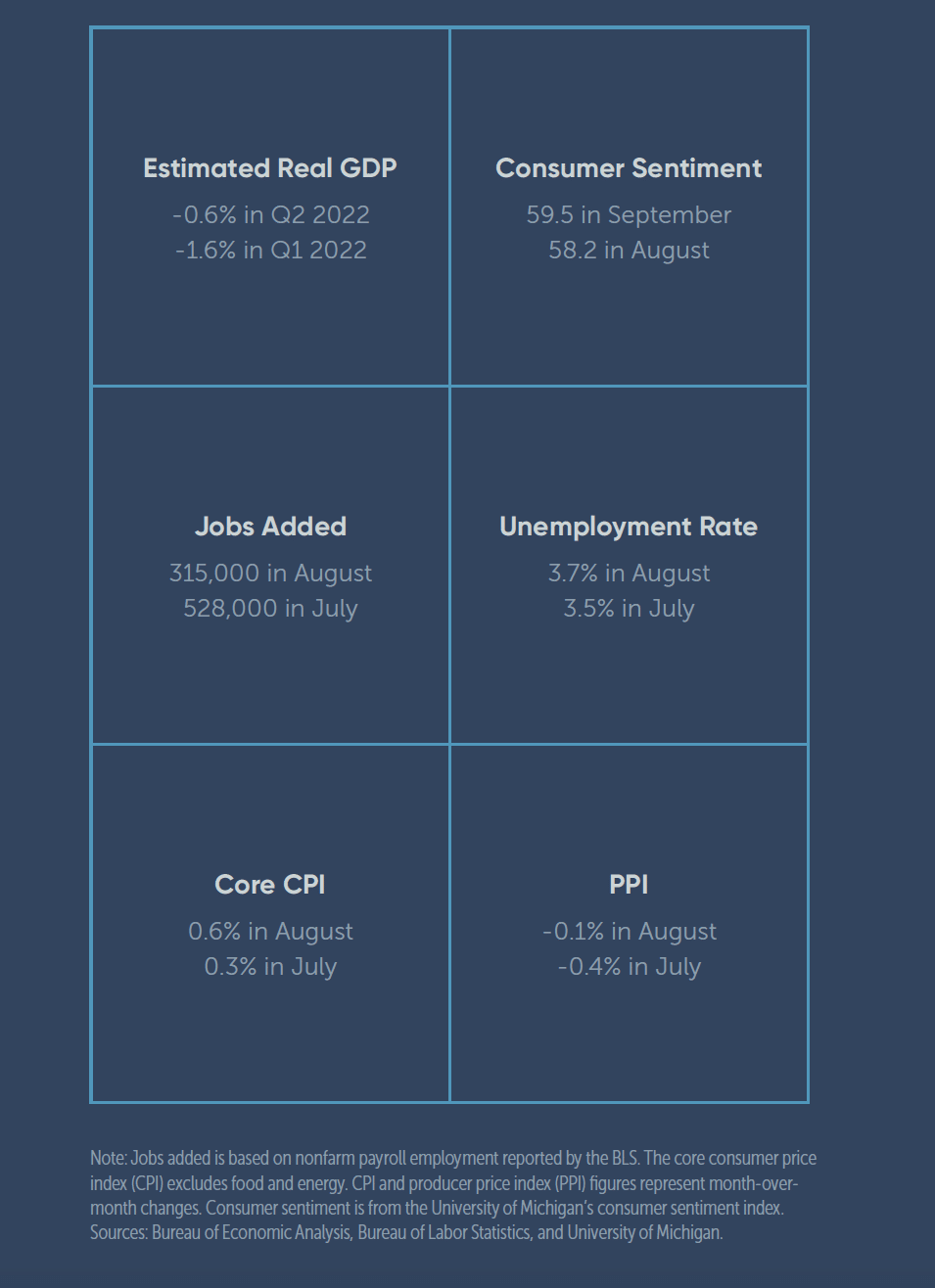

While inflation has moderated since June, it remains stubbornly high, and the Federal Reserve took further action by raising its benchmark rate again in September. Shocks happening abroad are the main contributor, and speculation about the world entering recession early next year has risen.

Top Risks:

The war in Ukraine has led to a dramatic increase in gas prices, with Europe facing limited supply to heat homes and power factories this winter. This will impact nearly every good produced in the region, from wine glasses to fertilizer. In the U.S., housing costs are likely to keep inflation higher.

Sources of Stability:

Employment remains strong, with the U.S. adding an average of 440,000 jobs a month this year. Consumers are seeing some relief at the gas pump as the price of oil has dropped. Home prices are also cooling, and lumber prices have fallen more than 70% from their March peak.

In the Spotlight:

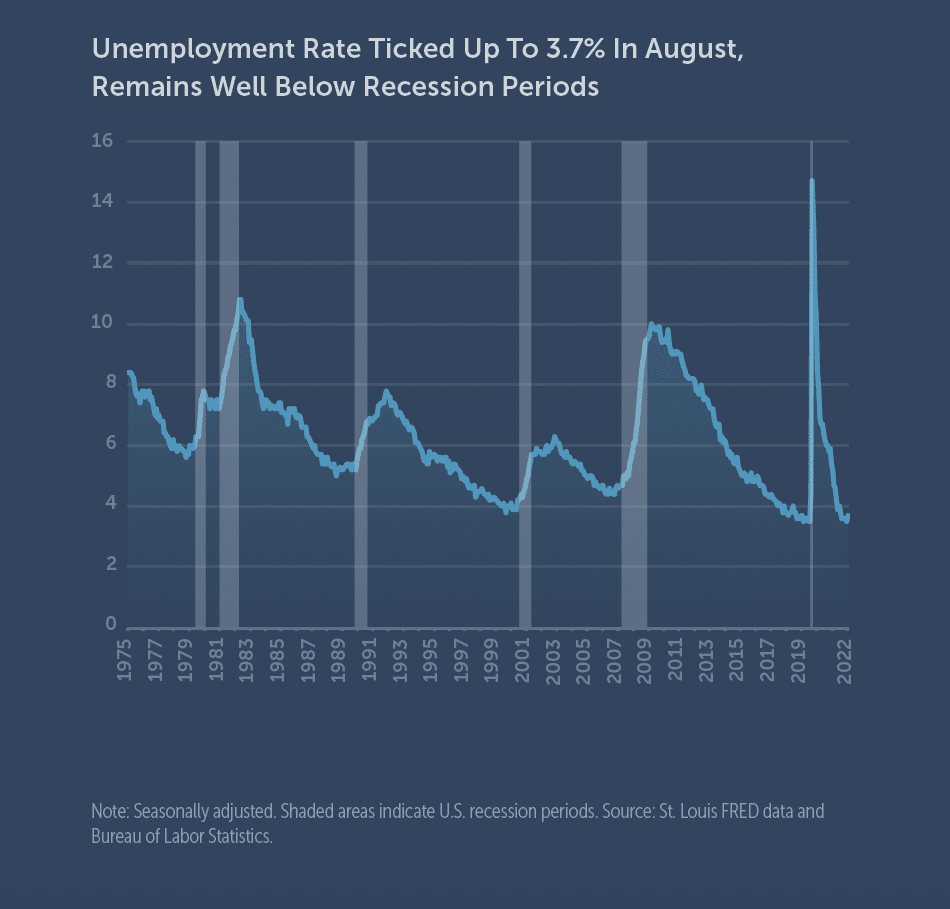

The big paradox to the outlook for slower growth is the strong labor market, prompting the key question of whether the Fed’s actions to tame inflation will push up the unemployment rate. At the end of July, there were 11.2 million job openings compared with six million people unemployed in August, according to Bureau of Labor Statistics data. This has led to severe shortages in many occupations. Even so, the unemployment rate ticked up slightly in August, and the Fed raised its unemployment rate prediction for 2023 from 3.9% in June to 4.4% as of its September FOMC meeting.

Key Areas to Watch

Interest Rates

September was a tough month for markets as the Fed bumped up its main policy rate another 75 basis points. The target range for the benchmark federal funds rate is now 3% to 3.25%, the highest since before the 2008 financial crisis and up from near zero at the start of this year. The question for markets is how high interest rates will need to go to cool the economy and bring down core inflation.

Fed’s Balance Sheet

The Fed also announced it would continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, which it began buying when the pandemic began to help push bond yields lower. Reducing these holdings causes the reverse—yields go up. When yields go up, it becomes less appealing to buy lower-yielding bonds already in the market, and it becomes more expensive for borrowers to raise money by issuing new bonds.

Europe’s Energy Crisis

Russia continues to restrict its natural gas supplies to Europe in response to Western sanctions on Russia for invading Ukraine. As a result, the continent has been grappling with soaring energy prices for most of the year. There are concerns that the European Union won’t have enough supply to meet demand this winter, which has led to pledges to cut consumption. These developments are slowing global growth and creating a cost-of-living crisis for Europeans.

China’s Slowing Economy

China’s economy is expected to slow to about 3.3% in 2022, the lowest in 40 years, excluding 2020, according to the International Monetary Fund. It also faces a housing crisis like the one the U.S. experienced in 2008, with home sales down 40% in July. Housing makes up much more of an individual’s net worth in China than in the U.S., creating greater risks to its economy. Because China’s economy is the second largest, this adds to the likelihood of a global recession.

Strength of U.S. Dollar

From September 2021 through end of September 2022, the U.S. dollar index, a measure of the performance of the U.S. dollar against a basket of developed market currencies, rose from about 92 to about 112, a two-decade high. In September, the British pound dropped to the lowest level against the dollar since 1985, and the euro remains close to parity against the dollar. The yen has also struggled against the dollar, and in September Japan’s authorities intervened to prop up the currency in the foreign exchange market for this first time since 1998.

Housing Market

The extremely tight housing market could lead to inflation being more persistent than economists are forecasting. While rising interest rates will slow demand for housing, the U.S. faces a housing shortage of about four million homes, helping to explain why through July the year-over-year increase in home prices was about 16%, though slower than 18% in June. That shortage is why rents have been rising so dramatically. Rising interest rates will slow building and exacerbate the shortage problem.

Consumer Spending

Consumer spending slowed in July, rising only 0.1% compared with 1% in June, possibly due to inflation concerns. However, consumers are starting to see relief in some spending areas. After peaking at over $5 a gallon in June, the average national price of gasoline fell to $3.70 in late September. And because of the slowdown in housing, lumber prices have fallen more than 70% from their peak in March.

Key Economic Indicators

Where do markets go from here?

- Markets tend to lead economic data: Markets tend to decline before economic data worsens, meaning reacting now usually means you are reacting after markets have already moved.

- Expect volatility: There’s increased speculation right now on where inflation is headed and the nature and extent of any recession, and the market does not like ambiguity. The global geopolitical environment—particularly the cost of energy—can also be expected to continue to contribute to heightened volatility.

- Reacting after markets have fallen rarely works: Expected returns are now meaningfully higher in both stock and bond markets than they were at the start of the year. Also, while nothing is guaranteed, both stock and bond markets tend to do relatively well after large negative return periods.

What are the investment planning implications?

- Tax-loss harvesting: Take advantage of lower prices to lock in investment losses and offset any gains. Give yourself a tax break—if available.

- Manage risk: Rebalancing keeps overall risk characteristics of the portfolio aligned with your financial objectives.

- Look beyond stocks and bonds: Some alternative asset classes are doing what we’d expect—performance is not correlated to stocks and bonds, and they are providing both return and diversification benefits.

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based upon third party data which may become outdated or otherwise superseded without notice. Third party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Individuals should speak with their financial professional before implementing any investment planning strategies mentioned above. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency have approved, determined the accuracy, or confirmed the adequacy of this article. R-22-4443

© 2022 Buckingham Wealth Partners. Buckingham Strategic Wealth, LLC, & Buckingham Strategic Partners, LLC (Collectively, Buckingham Wealth Partners).

Larry Swedroe

As Head of Financial and Economic Research, Larry Swedroe has authored or co-authored 16 financial books and devotes all of his time to research and education in the areas of investing, financial planning and behavioral finance.